Time: 2024-07-16

The European session today will be relatively quiet on the data front , with only the Eurozone Industrial Production data being released , which is not expected to have a significant impact on the market . However , in the American session , investors will be closely watching the BoC Business Outlook Survey and anticipating remarks from Fed Chair Jerome Powell at the Economic Club of Washington , D.C.

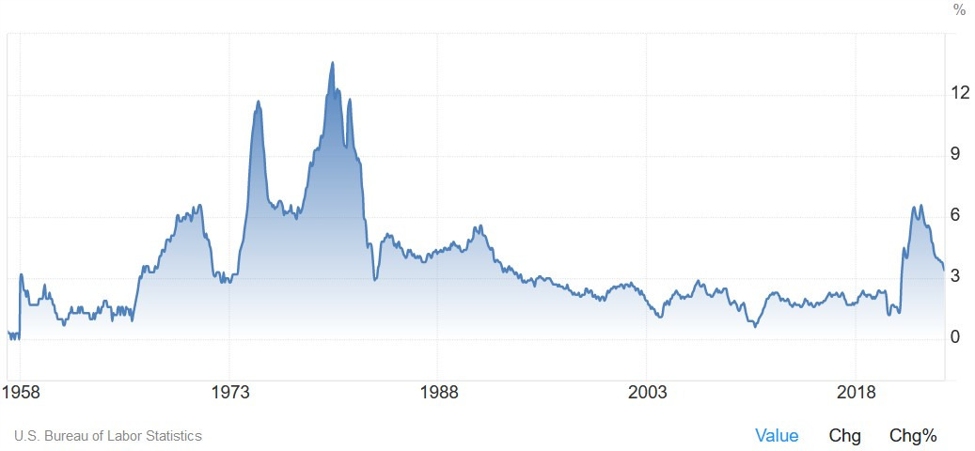

Powell , who recently testified before Congress , maintained a neutral stance and refrained from providing any clear forward guidance . Despite market expectations of a rate cut in September , the Fed 's decision will largely depend on the latest US Consumer Price Index ( CPI ) report and any changes in the Fed 's language towards a more dovish stance.

In the upcoming American session , investors are eagerly awaiting the release of key US economic indicators , including the US CPI and US Jobless Claims figures . The US CPI Year - over - Year ( Y / Y ) is projected to come in at 3.1 % , with the Month - over - Month ( M / M ) measure expected to show a slight increase . Similarly , the Core CPI Y / Y is forecasted to remain stable at 3.4 % , with a slight uptick in the M / M figure.

If the US CPI report reflects positive economic conditions , the Fed may adopt a more dovish tone in the upcoming meetings . Additionally , Fed Chair Powell might signal a potential rate cut in September during the Jackson Hole Symposium if subsequent economic data remains favorable.

On the labor market front , the US Jobless Claims figures continue to be a crucial indicator of the economy 's health . Initial Claims have remained relatively steady within a specific range , indicating stability in layoffs . However , Continuing Claims have been gradually increasing , suggesting a more cautious approach to hiring.

As the job market dynamics evolve , policymakers and investors will closely monitor the weekly jobless claims data to assess the overall employment trends . This week , Initial Claims are expected to be around 236 K , while Continuing Claims are projected to be slightly higher compared to the previous week.

Overall , the upcoming economic data releases and central bank communications , particularly from Jerome Powell , will provide valuable insights into the future direction of monetary policy and its potential impact on the financial markets.