Time: 2024-07-02

The S&P 500 (SPX) experienced a decline after a three-week winning streak, with the Dow Jones Industrial Average (DJIA) and the Nasdaq-100 (NDX) also seeing small losses. Despite this, the benchmark indexes closed out June on a positive note, wrapping up a successful first half of the year. Stocks faced challenges on Friday due to political uncertainty following the U.S. presidential debate. The Federal Reserve emphasized the need for consistent inflation data before considering interest rate reductions, despite signs of a slowdown. Economic indicators showed a mixed picture, with GDP and consumer spending numbers reflecting both strength and weakness.

The revised Q1 2024 GDP exceeded expectations, though it still showed a slowdown from the previous quarter. Consumer spending in May fell short of estimates, but personal income saw a rise, driven by strong consumer sentiment in June. The potential for an interest rate cut in September increased with a deceleration in inflation. Concerns remain about the labor market, with the upcoming job market report expected to provide clarity on the situation. While consumers are facing inflation and high interest rates, continued income growth could support spending habits.

Several economic events are set to unfold in the coming week, with significant impacts on the market. The ISM Manufacturing PMI on July 1 and the ISM Services PMI on July 3 will provide insights into the U.S. manufacturing and services sectors, influencing economic forecasts. The Nonfarm Payrolls and Unemployment reports on July 5 will offer crucial data on job creation and the labor market, guiding policymakers on future decisions. Average Hourly Earnings data will also be released on the same day, highlighting wage inflation trends and their impact on the economy.

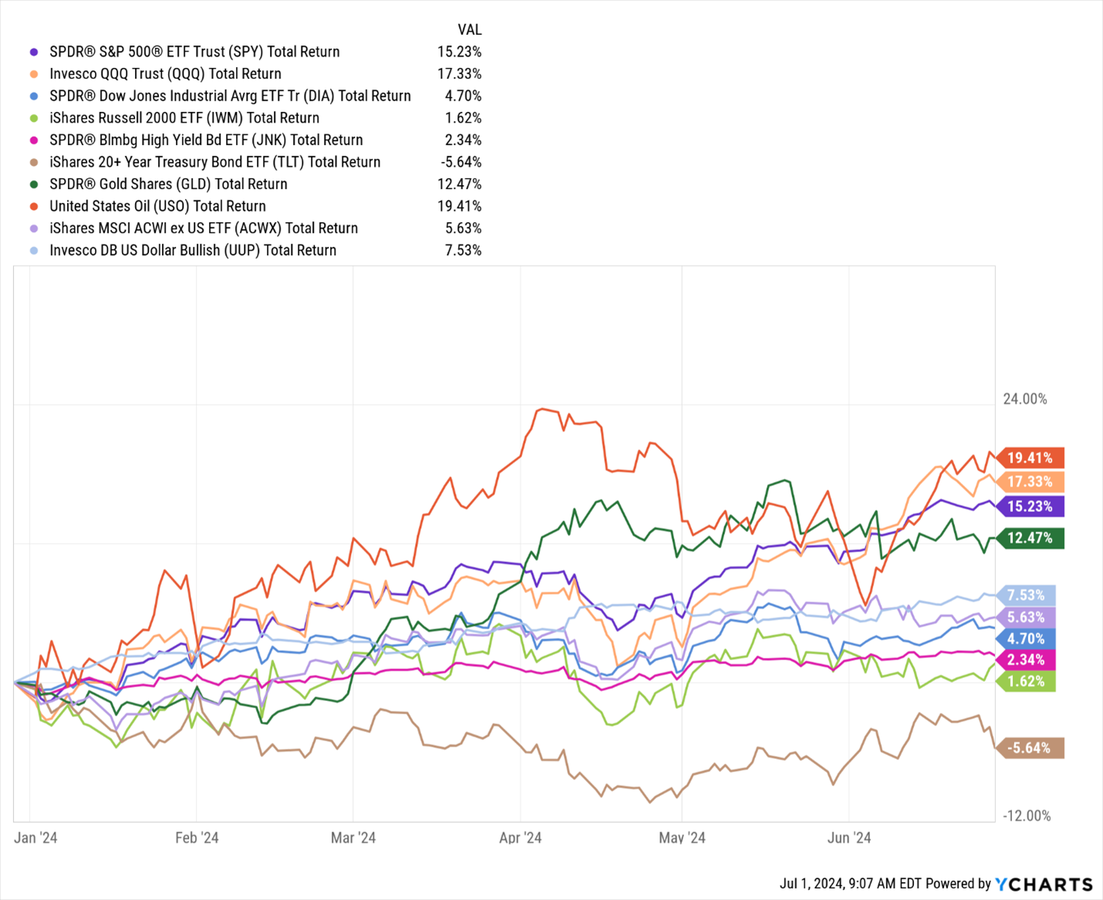

The first half of 2024 showcased varying performances across different asset classes. Technology stocks, such as the Invesco QQQ Trust (QQQ), led the way with a strong return, while the United States Oil Fund (USO) surprisingly outperformed with the best performance. The SPDR S&P 500 ETF Trust (SPY) and SPDR Gold Shares ETF (GLD) also delivered positive returns. The market saw mixed results for bonds, with riskier bonds outperforming government debt. S&P 500 sectors displayed varying performances, with Communication Services and Technology sectors leading the pack, while Real Estate sector faced losses. Overall, the market remains bullish, with offensive sectors outperforming defensive ones and a positive outlook for the future.