Time: 2024-07-11

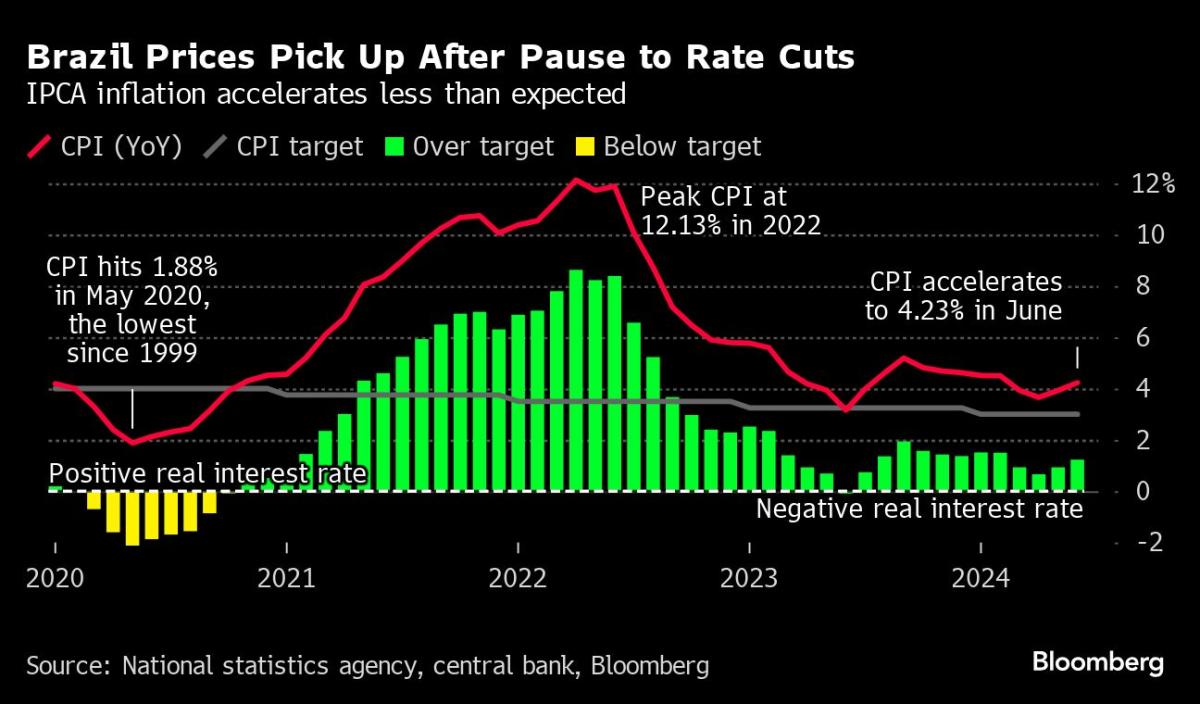

In June , Brazil experienced a notable increase in inflation , with the Consumer Price Index ( CPI ) rising by 4.23 % compared to the previous year . This surge in prices was primarily driven by significant adjustments in the retail prices of essential items such as potatoes and long - lasting milk . The Brazilian Institute of Geography and Statistics ( IBGE ) reported that the cost of food , including items for consumption at home and dining out , increased by 0.44 % during this period . Additionally , other goods like gasoline , water , sewage , and perfumes also saw notable price hikes , contributing to the overall inflation rate for the month.

The rise in inflation was attributed to various factors , including a lower supply of long - life milk due to off - season conditions in the Southeast and Midwest regions , as well as adverse weather affecting potato harvests in the South of Brazil . Despite these price increases , June 's inflation rate was lower than in May , with certain items such as airline tickets , papaya , and onions experiencing price declines during the month . The fluctuation in prices was largely influenced by market dynamics and seasonal factors affecting the availability of certain products.

The lower - than - expected inflation rate in June provided some relief to the central bank , which had faced criticism for pausing interest rate cuts to address inflationary pressures . Despite concerns over rising food costs and currency devaluation impacting price levels , the inflation rate remained below forecasts , supporting market sentiment towards monetary policy . The decision to maintain the benchmark interest rate at double digits reflects efforts to control inflation and stabilize the economy amid uncertainties surrounding government spending plans and currency fluctuations.

Economists have revised their inflation forecasts above the 3 % target , citing factors such as food price increases and currency depreciation as key drivers of inflation . While transportation costs declined in June , driven by lower airfares and fuel prices , ongoing economic challenges such as fluctuating exchange rates and rising fuel costs pose risks to future inflation levels . The central bank 's autonomous stance on monetary policy has faced criticism from President Luiz Inacio Lula da Silva , who perceives high borrowing costs as hindering economic growth and causing undue economic strain.

The clash between the government and the central bank has led to increased political tensions , with concerns that the president may exert more pressure on monetary policies in the future . Despite criticisms of high interest rates and economic impacts , Lula 's approval ratings have risen , reflecting growing public support for his views on monetary policy and inflation control . A recent survey indicated that a majority of respondents agreed with Lula 's stance on interest rates and his criticisms of the central bank 's policies , highlighting public sentiment towards economic issues in Brazil.

In the midst of economic challenges and political debates on monetary policy , the central bank 's efforts to balance inflation control and economic growth remain a key focus . As Brazil navigates through inflationary pressures and market uncertainties , policymakers face the task of maintaining stability and addressing public concerns regarding rising prices and economic policies . The evolving landscape of economic indicators and public sentiment will continue to shape Brazil 's economic trajectory in the coming months.