Time: 2024-07-08

David Ellison 's company , Skydance Media , has received a crucial vote of approval for the acquisition of controlling shareholder National Amusements Inc. from Paramount Global . The special committee of Paramount 's board has blessed the deal after seven months of negotiations . The full board is set to consider the proposal soon . Bloomberg News reported the special committee vote , with a formal announcement expected on Monday . Representatives from NAI , Paramount , and Skydance did not respond to Deadline 's request for comment.

Under the Skydance agreement , Shari Redstone and her family will receive .75 billion , with additional funds allocated for Paramount debt repayment . The deal is anticipated to be completed in two parts , with a full merger between Skydance and Paramount Global to follow . NAI 's 80 % control of Paramount 's Class A shares presents a complex negotiation landscape . Skydance 's long - standing partnership with Paramount Pictures positions it favorably in preserving the entity 's current shape . The strategic vision behind this merger has garnered Redstone 's preference for Skydance over other suitors.

Despite initial setbacks in deal negotiations , Ellison and his backers remain determined to see the merger through . The challenges faced by Paramount in the streaming era have prompted a restructuring under a tripartite Office of the CEO . The company aims to reduce expenses , explore streaming partnerships , and drive improved performance under the new leadership . The impending downsizing will reshape the workforce as the company navigates through the merger process.

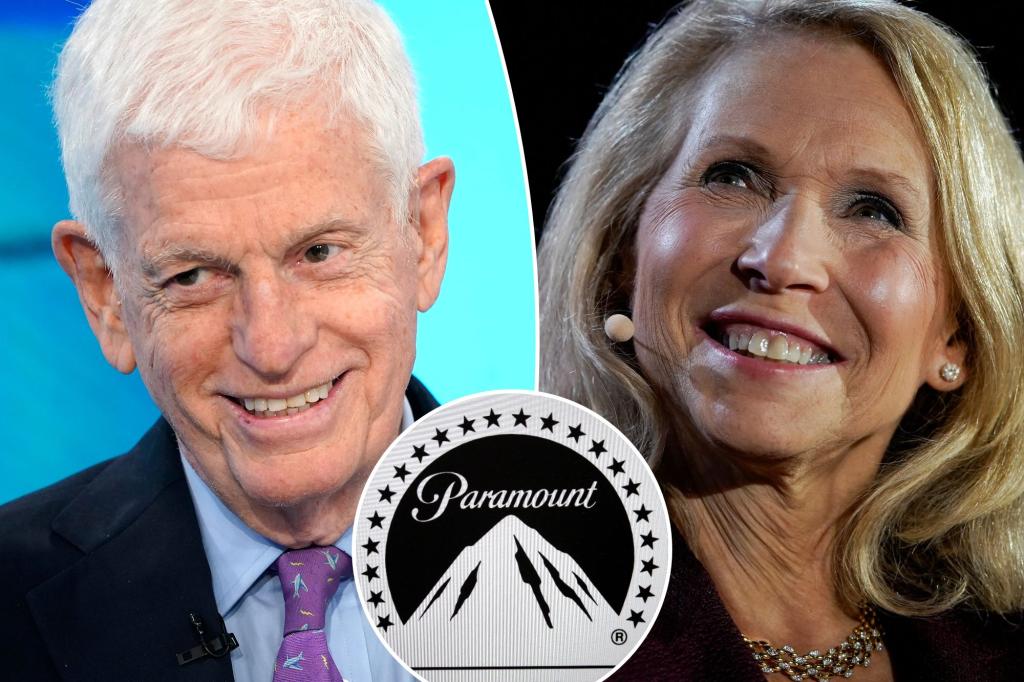

The proposed merger between Paramount and Skydance has garnered interest from key voting shareholder Mario Gabelli , who previously expressed skepticism but now considers the deal favorable for minority shareholders . Gabelli 's potential retention as an investor hinges on the structure of the transaction . While uncertainties remain , the estimated financial figures indicate a promising outcome for NAI shareholders . As the media landscape evolves , the merger between Paramount and Skydance could signal a significant shift in the industry 's dynamics.