Time: 2024-06-29

Nike Inc. faced a significant setback as its shares plummeted more than 12% in extended trading following disappointing quarterly revenue and a revised sales forecast, prompting several analysts to rethink their bullish stance on the stock. The stock, which had been oscillating within a rising wedge pattern, is now poised to break down, with a projected price target of $75 as calculated by a measured move technique.

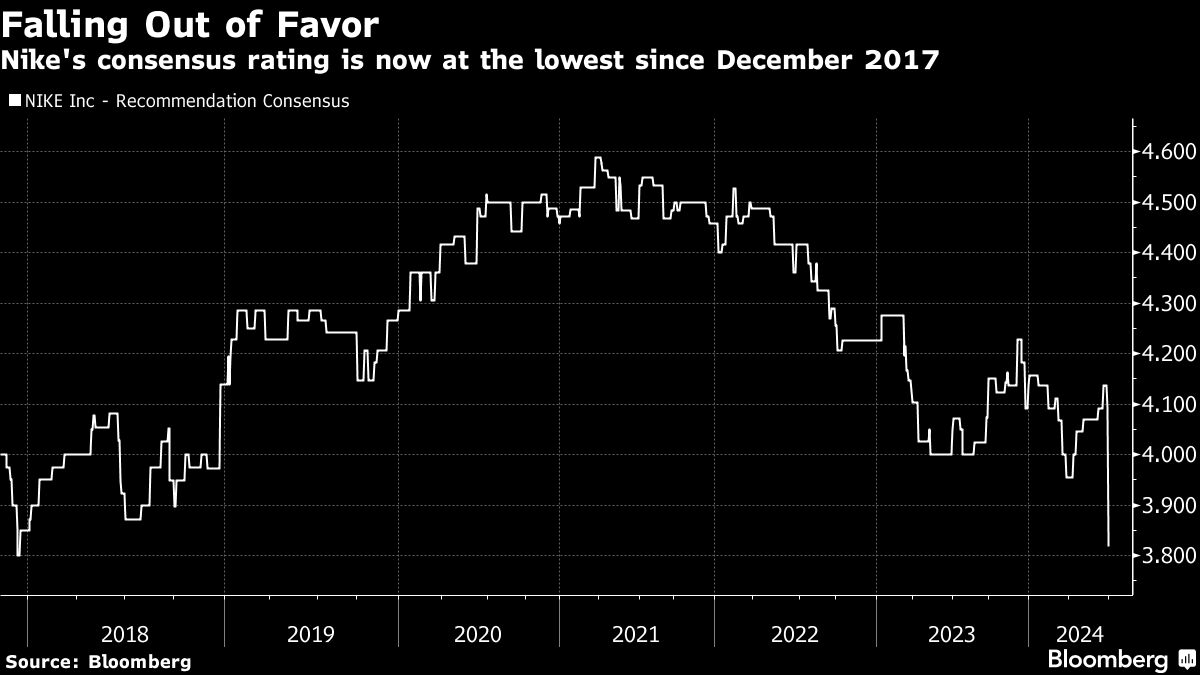

The sneaker giant's competition with rivals like Adidas AG has intensified, leading to a loss of market share and a decline in Wall Street analysts' confidence in the stock. Following Nikes' warning of a challenging year ahead, several brokerage firms, including JPMorgan Chase & Co and Morgan Stanley, downgraded their buy calls on the stock, pushing the consensus rating to a more than six-year low.

Wall Street's outlook on Nike has shifted significantly, with analysts like Morgan Stanley's Alex Straton cutting the stock to equal-weight due to a disappointing set of earnings and a reduced outlook. The average price target for Nike stands at $95, with 21 buy-equivalent recommendations, 20 holds, and three sells among analysts tracked by Bloomberg.

In conclusion, the road ahead for Nike seems challenging as it grapples with tough competition, changing consumer preferences, and a need for innovation to drive growth. While some analysts remain hopeful about the company's prospects, others are more cautious due to macroeconomic conditions and market volatility, signaling a period of uncertainty for the sportswear giant.