Time: 2024-06-27

Sanjay Mehrota, President & CEO of Micron Technology, presented the company's fiscal third-quarter results at the World Economic Forum in Davos, Switzerland on May 24th, 2022. Despite a 3% drop in Micron's shares in extended trading, the company outperformed expectations with adjusted earnings per share of 62 cents, surpassing the predicted 51 cents. Revenue for the quarter stood at $6.81 billion, slightly above the estimated $6.67 billion.

Micron's success can be attributed to the surge in artificial intelligence (AI) demand, particularly for its memory products essential for AI graphics processing units. With net income of $332 million, Micron has made significant strides compared to the previous year's loss of $1.9 billion. CEO Sanjay Mehrotra emphasized the company's AI-oriented products, predicting a continued increase in prices through 2024 despite steady demand in other sectors like smartphones and PCs.

Micron's high bandwidth memory, crucial for AI chips, is already sold out through 2025, showcasing the strong market demand for its cutting-edge technology. Analysts believe that Micron is poised to benefit greatly from the AI-driven growth in the semiconductor industry in the coming years.

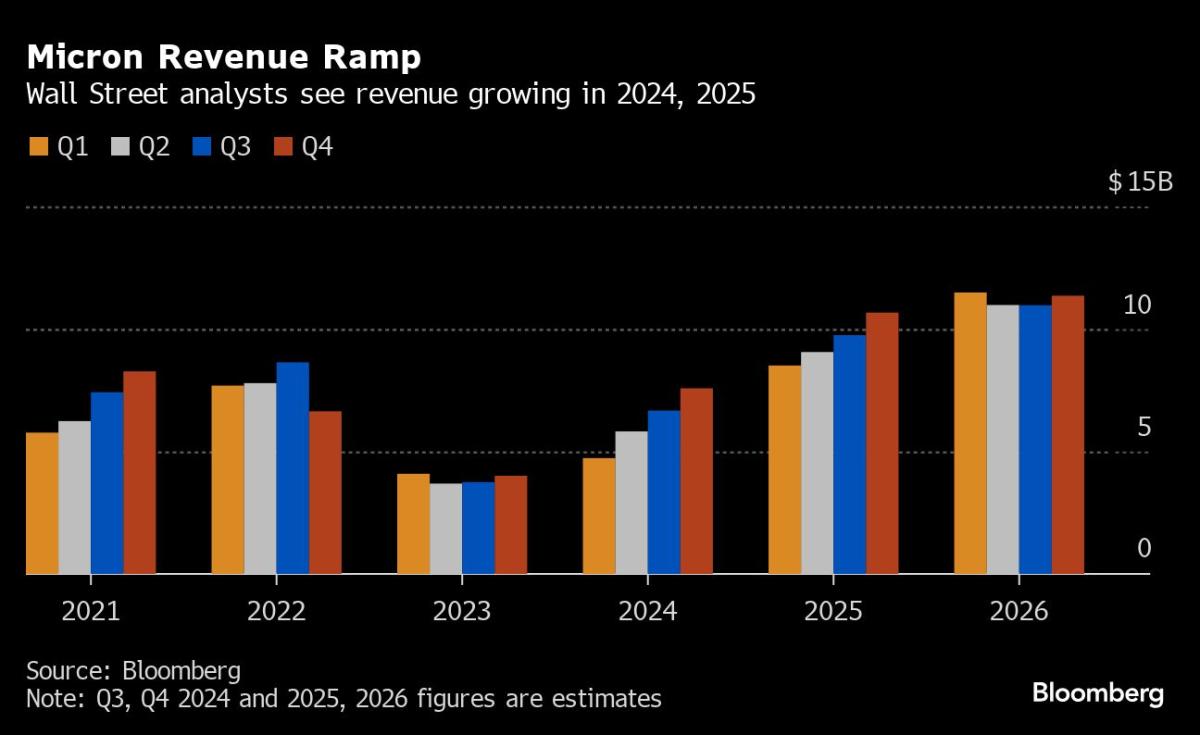

The impressive rally in Micron's stock, surging by 65% this year, has led to high market expectations. Wall Street projects a revenue of $6.7 billion for the quarter, representing an 80% increase from the same period last year. Analysts foresee Micron delivering a strong performance, driven by the demand for AI applications and high bandwidth memory chips.

Despite the optimistic outlook, there is a cautious sentiment among investors about the potential for post-earnings volatility. However, experts view any market dips following earnings as a buying opportunity, anticipating further growth in the memory segment. Micron's unique position in the AI market, coupled with its robust financial performance, sets a positive trajectory for the company in the ever-evolving semiconductor landscape.

In conclusion, Micron Technology's strategic focus on AI-driven products and cutting-edge memory solutions continues to propel its growth trajectory, positioning the company as a key player in the semiconductor industry. With a strong financial performance in the fiscal third quarter and optimistic market speculation surrounding its future prospects, Micron remains a top contender in the tech sector.