Time: 2024-06-25

Nvidia (NASDAQ: NVDA) has been making waves in the stock market, with its value skyrocketing and becoming the world's most valuable company. The company's success can be attributed to its focus on artificial intelligence and the use of its graphics processing units (GPUs) to power AI systems. In fact, Nvidia's stock price has more than doubled this year and tripled in 2023, leading to a market cap of over $3 trillion, surpassing giants like Apple and Microsoft. This success has also contributed significantly to the gains in the S&P 500 index.

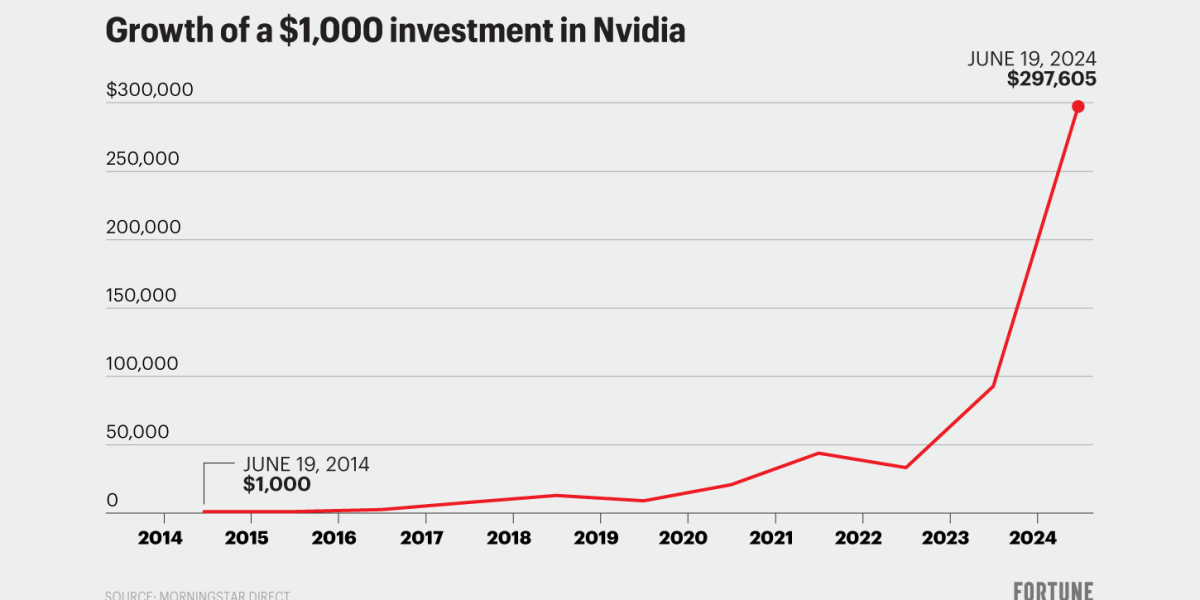

Investors who got in early on Nvidia have seen significant gains, with an investment of $1,000 in June 2014 now worth over $297,600. This cumulative growth of 29,660% highlights the meteoric rise of the company in recent years. Despite concerns about the stock being overpriced, analysts believe that Nvidia could see its market value soar to nearly $5 trillion in the coming year, showing optimism for its future.

The volatility of Nvidia's stock price in the past, with a dip in 2022 followed by a resurgence, has made it a popular choice among investors. The company has consistently outperformed the broader market, providing healthy shareholder returns. However, with the extreme concentration of returns in the S&P 500 attributed to companies like Nvidia, there are concerns about the impact of any fluctuations in its stock price on the overall market performance.

Retail investors are increasingly buying into index funds like the S&P 500, which makes them more vulnerable to the movements of companies like Nvidia. Analysts have been warning about the stock being overpriced, but there are reasons to remain optimistic. Major tech companies are heavily reliant on Nvidia's chips, and the growing investments in AI across various industries bode well for the company's future growth potential.

In conclusion, while there are concerns about the sustainability of Nvidia's current success, the company's strong position in the AI market and the continued demand for its products provide reasons for investors to consider its long-term prospects. With the potential for further growth and market value appreciation, Nvidia remains a stock to watch in the coming years.