Time: 2024-06-18

While Open Interest increased, Funding Rate stalled. The price of the altcoin might keep swinging between $3,400 and $3,600 in the short term.

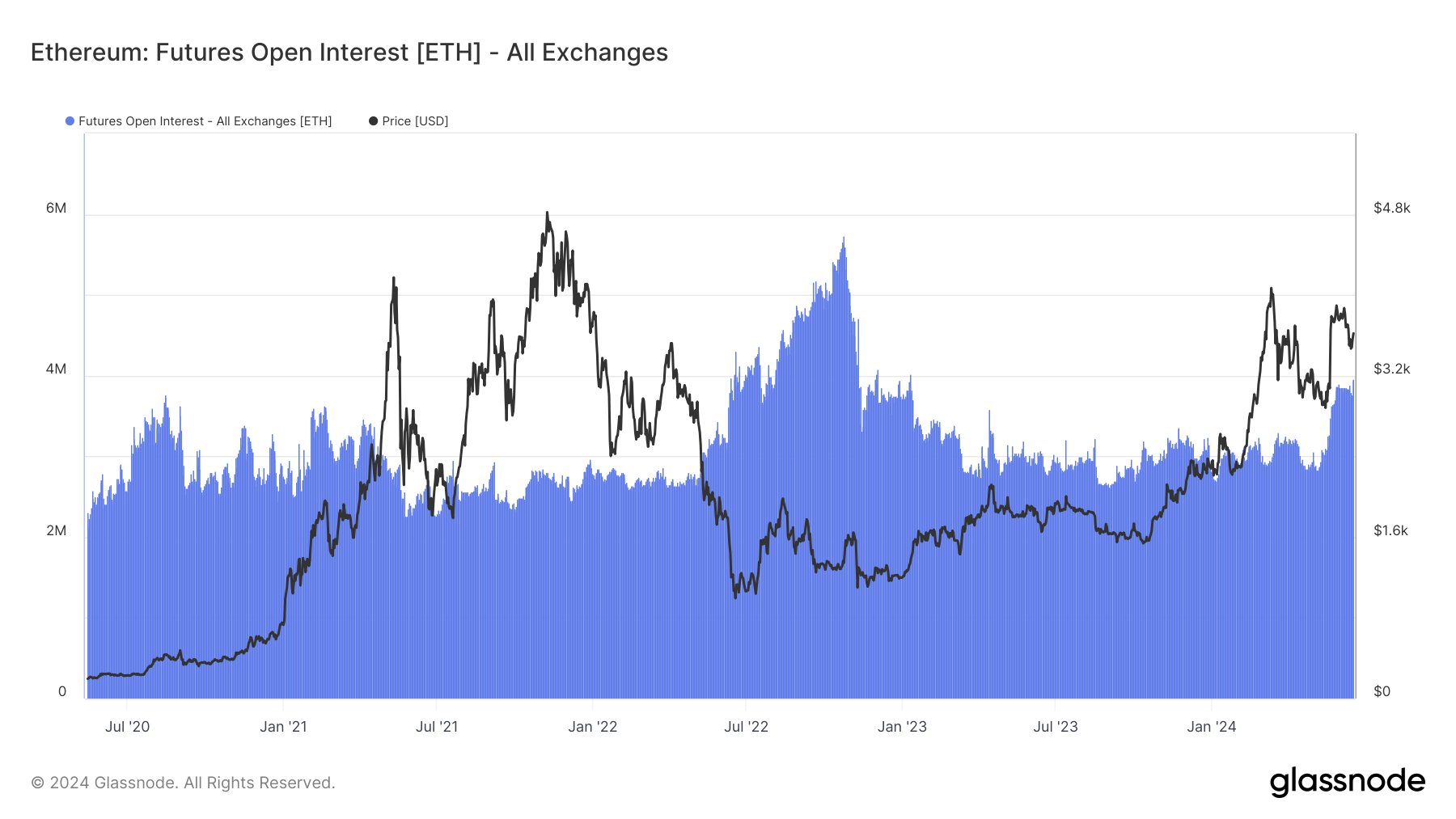

One day after Ethereums [ETH] Open Interest dropped to $13.14 billion, it added another billion to its value. At press time, the Open Interest (OI) was $14.10 billion, according to data from Glassnode.

OI is the value of outstanding futures contracts in the market. Whenever it decreases, it means that traders are closing positions related to the cryptocurrency. However, an increase suggests otherwise.

Thus, the rise in Ethereum contracts indicates increased speculative activity regarding the altcoin. In many instances, an increase in OI offers strength to the price direction.

For ETH, it might not be different. As of this writing, ETH changed hands at $3,563, representing a slight 1.10% increase within the last hour.

By the look of things, this could be the start of a significant uptrend for the cryptocurrency.

Onchain Highlights

DEFINITION: The total amount of funds allocated in open futures contracts.

Ethereum futures open interest has shown substantial volatility throughout 2024, significantly influenced by recent regulatory developments.

Following the approval of spot Ethereum ETFs by the US Securities and Exchange Commission (SEC), open interest in Ethereum futures surged, reaching new highs.

On June 17, futures open interest across all exchanges neared 4.0 million ETH, coinciding with a price movement towards $3,600 per ETH.

The SECs approval of Ethereum ETFs marked a significant milestone, signaling increased regulatory acceptance and boosting investor confidence. The introduction of these ETFs has driven notable market activity, particularly in the derivatives sector, with futures open interest hitting record levels due to heightened speculative and institutional involvement.

Despite the outlook, Ethereums Funding Rate has remained stagnant since the 8th of June. Funding Rate is the cost of holding an open position in the derivatives market.

If funding is positive, it means the contract price is trading at a premium to the spot price. In a situation like this, longs pay short to keep their positions open.

On the other hand, a negative funding implies that shorts are paying longs. Also, the contract value of the cryptocurrency is at a discount.

For ETH, the low Funding Rate and high price means that spot volume might soon begin to pick up.

If this is the case, the reasonable inference could be a bullish move for Ethereum. Nonetheless, the price of the cryptocurrency might fail to hit $4,000 in the coming week.